Freehold vs Leasehold in Dubai

Know about the differences between Freehold and Leasehold

Know about the differences between Freehold and Leasehold

Some of The Finest Hotels & Resorts in Dubai

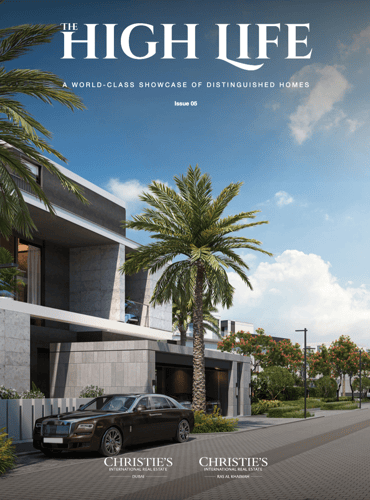

The true hallmark of a luxury lifestyle is its ability to blend unparalleled sophistication with complete privacy

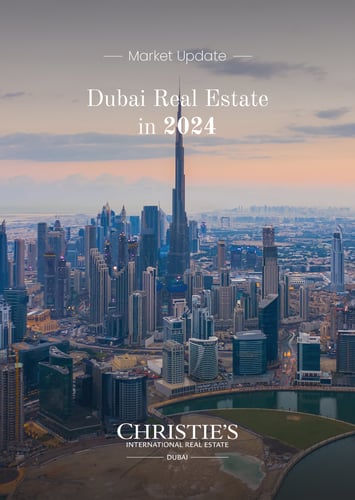

Dubai real estate enjoyed 111 sales of homes valued at above $10 million individually during the first quarter of 2025

Explore the Best Healthcare Options in Dubai

Dubai AI Week is bringing together artificial intelligence industry leaders and experts from over 100 countries

Even by Palm Jumeirah standards, this six-bedroom beachfront villa is unparalleled

Explore the Best Rated Private Schools in Dubai with Top Quality Learning Environment

The world's financial markets are in a collective period of transition

Luxury real estate in Dubai is famous for its ability to provide comprehensive luxury lifestyles

The Dubai real estate market has registered transactions in excess of AED 140 billion during the first quarter of 2025

The most anticipated night in Dubai's sporting and social calendars is here again

Dubai is a global hub for luxury and this reflects in its residences

Real estate assets can now be transformed into digital tokens using blockchain, allowing for co-ownership.

A world-class showcase of distinguished homes

From the landmark Burj Khalifa to One Za'abeel

From iconic communities like the Palm Jumeirah to penthouse luxury on Bluewaters Island

Recent market reports show the city is set to perform better than major luxury hubs like New York, London and Singapore

The Best Golf Communities in Dubai

A Glimpse into Future with Exclusive Branded Residences

The Dubai real estate market achieved unprecedented transaction numbers last year

A Closer Look at Dubai's Most Exclusive Penthouses That Made Headlines!

A truly one-of-a-kind workspace at the Burj Khalifa, enjoying 360-degree city views

A Glimpse Into Dubai's Most Prestigious Real Estate of 2025