Market Performance

The table below highlights the diverse real estate opportunities available in Dubai and the strong demand from investors and home-buyers in these areas. From established residential communities like Jumeirah Village Circle and Dubai Marina to emerging areas like Dubai Creek Harbour and Al Hebiah Fifth, Dubai's real estate market continues to thrive and evolve, offering a wide range of options for those looking to invest or live in the city.

Here are the top five areas in Dubai according to the sales volume and value recorded by the Dubai Land Department.

| Area | Sales Volume | Sales Value |

| Jumeirah Village Circle | 3,407 | AED 3.15 |

| Business Bay | 2,477 | AED 5.80B |

| Dubai Creek Harbour | 1,770 | AED 7.45B |

| Al Hebiah Fifth | 1,465 | AED 4.34B |

| Dubai Marina | 1,255 | AED 2.55B |

Jumeirah Village Circle (JVC) was the most popular area for buying properties in Dubai, with 3,406 transactions worth AED3.15 billion. The area offers a range of apartments and villas in a well-connected location. Dubai Marina was the 5th most preferred area, with 1,254 transactions worth AED2.54 billion. The waterfront community is known for its high-end lifestyle and stunning views.

Price Trends for Ready and Off-Plan Properties

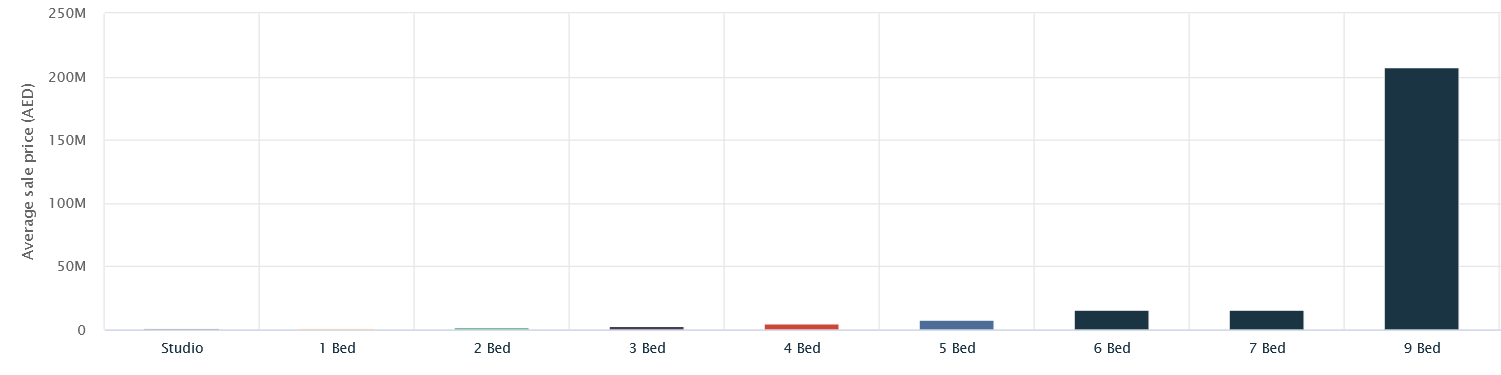

Real estate transactions were analysed to determine the average price, average number of transactions and average price-per-square-foot for various property types. Studios accounted for 4,160 transactions, with a total value of AED2.35B and an average price of AED565K, equating to AED1,266 per sq.ft.One-bedroom properties saw 9,347 transactions with a total value of AED10.90B, yielding an average price of AED1.16M and AED1,489 per sq.ft. For two-bedroom properties, there were 5,916 transactions totaling AED13.35B, with an average price of AED2.25M and AED1,725 per sq.ft.

Three-bedroom properties witnessed 3,348 transactions valued at AED11.84B averaging AED3.53M per unit and AED1,587 per sq.ft. Four-bedroom properties had 2,079 transactions with a total value of AED11.24B, and an average price of AED5.41M, translating to AED1,413 per sq.ft.

In the luxury segment, five-bedroom properties had 781 transactions, amounting to AED6.28B in total value and an average price of AED8.04M or AED1,354 per sq.ft. Six-bedroom properties saw 160 transactions, totaling AED2.65B with an average price of AED16.56M and AED2,003 per sq.ft.

Seven-bedroom properties had 70 transactions worth AED987.53M, averaging AED14.10M per unit and AED1,156 per sq.ft. Finally, there was a single transaction for a nine-bedroom property, valued at AED410M, equating to a remarkable AED10,521 per sq.ft.

Dubai Marina

The average price per sq.ft for an apartment in Dubai Marina increased by 7.3%, from AED1,272.17 in Q4 2022 to AED1,365.33 in Q1 2023.

Arabian Ranches

The average price per sq.ft. for a villa in Arabian Ranches increased by 6.4%, from AED1,223.67/sq.ft in Q4 2022 to AED1,302.33/sq.ft in Q1 2023. The Current Gross Investment Yield in Arabian Ranches Area is 5.20%.

Palm Jumeirah Fronds – Garden Homes

The average price per sq.ft for a villa in Palm Jumeirah Fronds – Garden Homes decreased by -0.78%, from AED3,404.5 in Q4 2022 to AED3,377.83 in Q1 2023. The Current Gross Investment Yield in Palm Jumeirah Area is 5.22%.

The price increases reflect the high demand and limited supply of properties in Dubai, as well as the improved economic outlook and investor confidence. The luxury real estate market continued to thrive, with an 8% volume increase Q-o-Q and a 67% increase YoY for properties sold above the AED10 million threshold.

Off-Plan Projects

Off-plan properties accounted for 62% of the total sales transactions in Q1 2023. This trend highlights the ongoing development and expansion of the city's real estate landscape, offering a wide range of opportunities for both local and international investors. In Q1 2023, off-plan sales reached 15,948 transactions compared to 8,467 in Q1 2022, an increase of 88.4% and an increase of 8% over Q4 2022.