Dubai, it is becoming more appealing to invest in property. The price of homes in Dubai is only a fraction of what other properties in major international cities such as London and Singapore cost.

Rising commodity prices have caused the cost of building materials to increase globally. This is forcing developers to find it more costly to build projects. This is also set against the backdrop of weakening global currencies.

Despite the strong UAE dirham, the UAE developers are not feeling the effects of the currency's rise. An expert at Christie’s International Real Estate Dubai noted that the cost of importing goods is cheaper than the global average and not struggling with the same cost hikes.

|

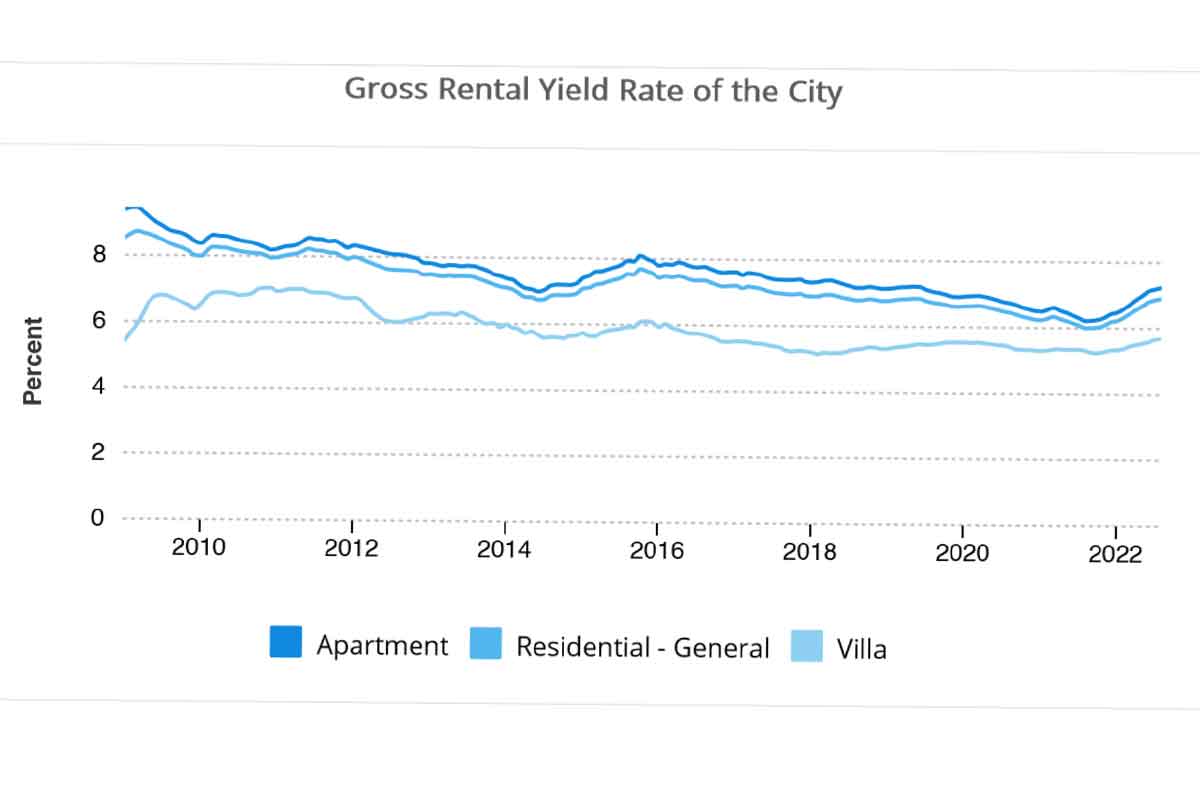

Despite the various factors that affect the property market in Dubai, the city still offers the highest yields in the world when compared to other major urban areas. For instance, if you look at Paris and Singapore, the yields are around 2.5%. On the other hand, in Dubai, you can get up to 8% yield.

The increasing number of Europeans & Russians who are looking to invest in Dubai has made the city an ever-safer place to invest.

The growing population, the ease of visas and the growth-oriented government measures are expected to increase the demand for housing units. This will be the main factor that will affect the supply and demand balance.